what is an open end equity lease

We just have to think of transport and courier companies they prefer to amortize the real cost of depreciation instead of paying. You can return the vehicle and either receive a credit or a bill for the difference between what you owe and how much the vehicle is sold for.

What Is The Difference Between An Open Vs Closed Lease

The open-end TRAC lease has been a staple in the fleet industry for decades.

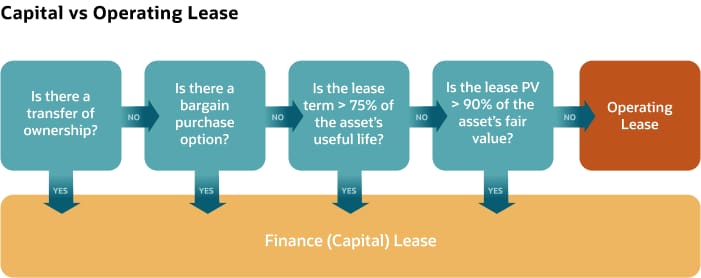

. Closed End Prime 10 percent. Lease term-Lease term comprises at least 75 of the useful life of the asset. Bargain purchase option-Lessee can buy an asset at the end of term at a value below market price.

This is because a closed-end option means the dealer assumes responsibility for any depreciation in value beyond what has. Lease equity is when your car is worth more at the end of the lease than the buyout that was established when the lease began. The open-end lease puts all the financial risks on the lessee.

The dealer then applies your equity in the car toward a new car purchase or lease. An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing. The lessee has the option of purchasing selling or trading-in the leased vehicle at the end of the contract for the GRV.

The employer takes all the financial risk. An open-end lease is one in which the lessee a business to be clear these arent available to the general public agrees to accept the financial risk. After this period the lease may be terminated at any time without penalty.

TRAC is an acronym for terminal rental adjustment clause However the basic principles of the TRAC lease sometimes are misunderstood. Open-End TRAC Terminal Rental Adjustment Clause Lease. With the open-ended lease you are guaranteeing the residual or buy out value of the vehicle at the end of the lease term which is structed.

Because a leased vehicles actual cash value doesnt equal the residual value until the end of a lease term having a leased car with equity is quite rare. Open-end versus closed-end leases. There are two types of agreements you might enter into and closed-end is generally preferable for the average consumer.

In an open-end lease the lessee agrees to a minimum term thats. If you have equity in your leased car you can trade the car in and use the equity as a down payment on a new car. This is how that sort of deal works.

This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages. This type of lease is also known as a finance lease which as the name implies permits the lessee to determine the vehicles service life after a short minimum term usually 12 months. Present value-The present value of the lease payment is 90 of the fair value of the asset at the beginning.

Understanding Lease Equity. In most open-end leases you are also entitled to any refund if the actual. Open End 36 months.

Lets take a closer look at the two most common options available to commercial fleets. Open-end lease contracts are more compatible with businesses that have less predictable but greater mileage requirements than the average 12000 miles-per-year of a non-business lease. CLOSED END LEASE COST COMPARISON.

At the end of the lease there are several options available to you including buyout the truck continue with the lease or return and replace the vehicle. This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages. It may also be referred to as a capital lease operating lease or TRAC lease With this type of lease your business has the option to retain equity in the vehicle while freeing up capital.

This works well for employers since the cost of the vehicles can be written-off or expensed. Open-end leases also exist and are most often used in the case of commercial business lending. Open End One-month LIBOR 50 percent.

Ford Taurus with standard fleet equipment. A basic tenet of accounting is matching expense to the time period in which it occurs. What is an open ended equity lease.

In a closed-end lease the lessor takes on the depreciation risk but the terms are more. Open-ended lease offer flexibility. An open-end lease with a TRAC allows a rental adjustment against the vehicles outstanding book value at the end of the lease.

At the end of the lease the equipment will revert to the lessor. What is an open-end lease. Open-end leases allow the lessee the one who borrows the vehicle to guarantee a value at the end of the lease.

Vehicle used 36 months60000 miles. A companyemployer will assume management and leasing of the car to its employees not the leasing company. Open-end TRAC leases enable fleet.

Open-end leases are also called finance leasesMay 26 2021. Instead of turning in the leased car the dealer buys the car from the leasing company at the residual price. This works well for employers since the cost of the vehicles can be written-off or expensed.

When you lease a car you dont own it unless you buy it at the end of the term. He will pay the bill if the depreciation is worse than expected. This is called the Guaranteed Residual Value GRV and is outlined in the lease contract.

The equipment has a useful life of 8 years and has no residual value. Closed-end leases are based on the idea that the distance you drive annually is fairly predictable typically 12000 miles annually. Closed End 36 months55000 miles07 per mile beyond 55000 miles.

However it is possible in some cases and we can explain how this can happen. This happens when the lessee drives less than the mileage allotted. Open- and closed-end leases.

Read more at the end of the lease period. At the time of the lease agreement the equipment has a fair value of 166000. In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the residual value stated in your lease deficiency see glossary entry Open-end lease for a definition of the three-payment rule.

An interest rate of 105 and straight-line depreciation are used. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. Open-end leases are pervasive in fleet leasing because they offer fleet managers greater control of asset utilization and disposal.

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Advantages And Disadvantages Of Capital Lease Accounting And Finance Financial Management Economics Lessons

Open Vs Closed End Leases What To Know Credit Karma

What Is The Difference Between An Open Vs Closed Lease

Hsbc Mutual Fund Launches Hsbc Mid Cap Fund In 2021 Smart Money Growing Wealth Asset Management

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Guide To Leasing A Car How It Works How Much It Costs

What Is The Difference Between An Open Vs Closed Lease

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Lease Accounting Calculations And Changes Netsuite

Lease Accounting Calculations And Changes Netsuite

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Capital Lease Vs Operating Lease What You Need To Know

Should You Choose An Open End Or A Closed End Car Lease Credit Finance

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Difference Between Operating And Financial Lease Finance Lease Lease Finance

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)